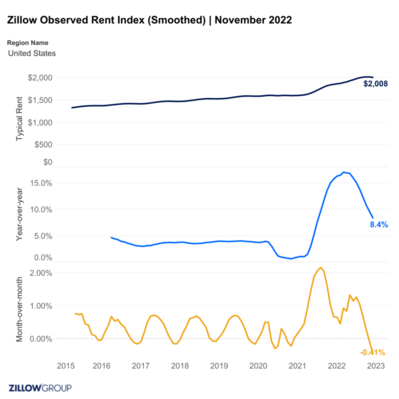

Rent prices saw the highest one-month decline in seven years in November, according to the latest report from Zillow.

From October to November, asking rents declined by 0.4%. Even taking into account the slow rent increases of this time of year, rents didn’t decline more than 0.1% even in the years leading up to the pandemic.

The first sign of a slowdown in rents was in October, when rents dropped by 0.1%, which stopped the above-average monthly rent increase trend that began in November 2020.

The typical national asking rent is $2,008, up by 8.4% since 2021, Zillow data suggests.

Rent growth reached its zenith of 17.1% year-over-year in February. Since then, it has been cooling gradually.

The challenges of this housing market, combined with high inflation and rising rents, have compelled people to share housing space with roommates or family. This has led to vacancies in rentals and pressured landlords to limit rent hikes, per the report.

Rents are falling the fastest on a month-over-month basis in Raleigh (-1.3%), Austin (-1.2%), Seattle (-1.1%), San Jose (-1.1%) and New York City (-1.0%). These areas are all tech employment hubs and typically have some of the highest rents in the country.

Not every metro is seeing rent declines. These cities saw rent growth: Louisville (0.7%), Memphis (0.6%), Buffalo (0.5%), Birmingham (0.4%) and Miami (0.4%).

Cities with the largest rent growth on a year-over-year basis are Las Vegas (0.2%), Sacramento (0.5%) and Phoenix (3.0%), as people find these areas to be more affordable than coastal tech hubs like Los Angeles and San Francisco.

The typical rent in San Jose, for example, is $3,283. This region has seen a year-over-year increase of 7.3% in rents, but even that region is cooling, with a month-over-month decrease of 1.11%. Typical rents in other coastal cities are $3,138 in San Francisco, $3,130 in New York, $3,056 in San Diego and $2,950 in Los Angeles.