The pandemic years, especially 2021, were a strange aberration where everyone moved, house prices skyrocketed, and nearly every real estate business posted record revenues.

Why it matters: 2022 is constantly being compared to 2021, which was anything but normal, and year-over-year comparisons are painting a deeply negative picture.

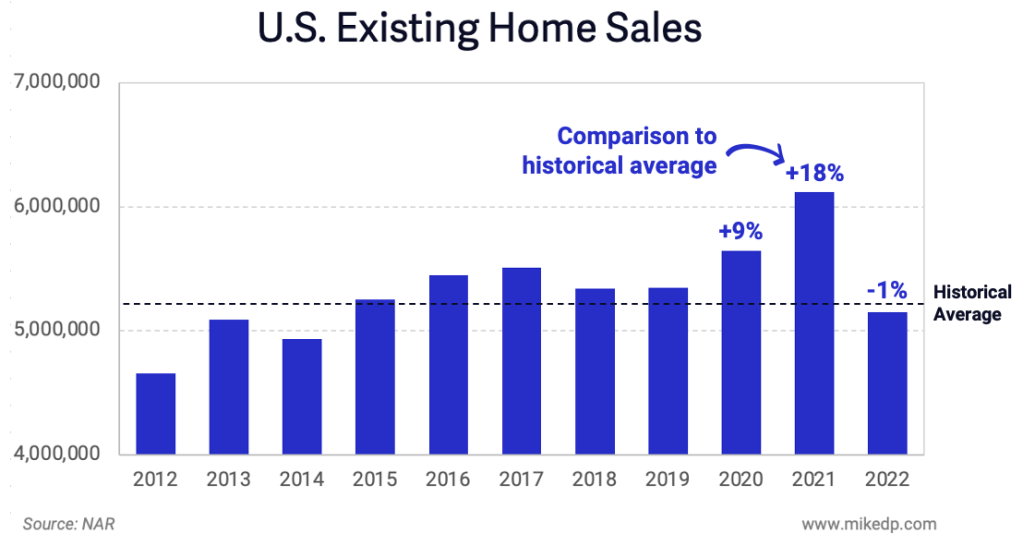

Dig deeper: Assuming a fairly conservative 5.15 million existing home sales in 2022, the comparison to last year is a sobering 16% drop — but 2021 is an outlier, not a benchmark.

- Compared to the historical average of the previous eight years (2012–2019), transaction volumes in 2022 would be down only 0.9%.

- By contrast, compared to the same historical average, transaction volumes were up 9% in 2020 and 18% in 2021 — notable outliers.

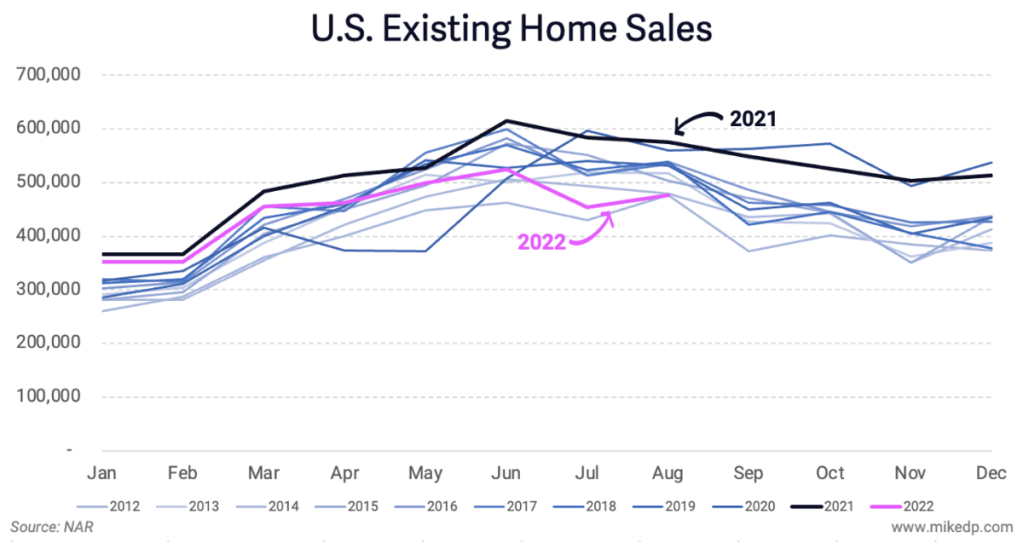

Comparing 2022’s monthly volumes to the historical average reveals recent volume declines that are still significant, but less extreme than a year-over-year comparison to 2021.

But in reality, 2022 has tracked favorably to the historical average and is still in somewhat “normal” territory, even considering the recent market slowdown.

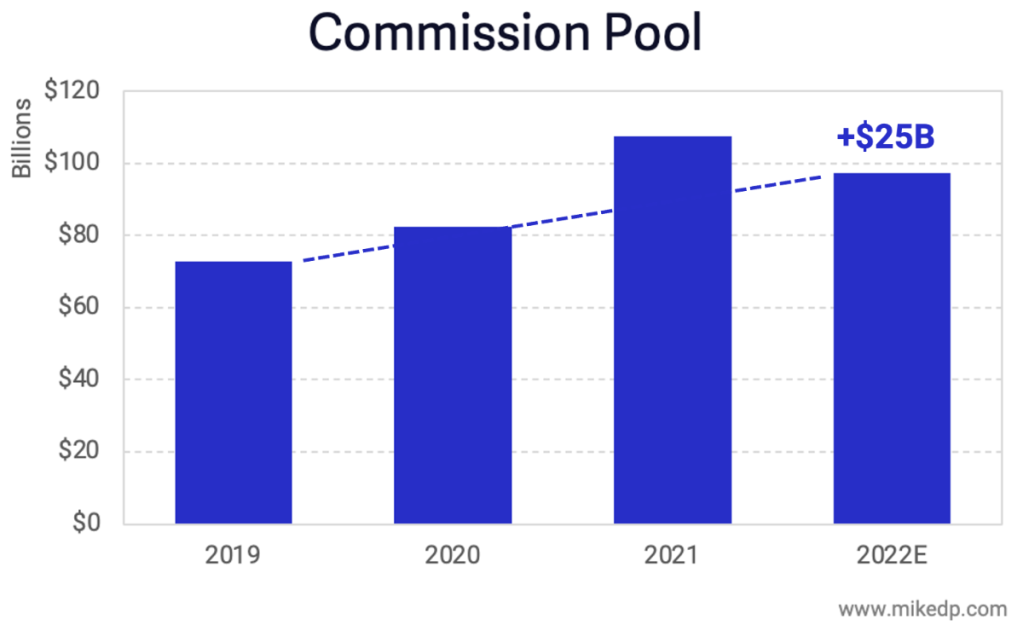

The big picture: Despite dropping volumes, the commission pool — which fuels the revenue of real estate agents, brokerages, portals, software providers, and more — is set to be 34%, or $25 billion, higher than 2019.

- This massive increase is being driven by rising home prices.

- It would take a drop to 4 million existing home sales for the commission pool to hit what it was in 2019: $73 billion

The bottom line: The pandemic years of 2020 and especially 2021 were radical outliers on a number of levels, real estate being just one.

- Issues of home affordability, dropping sales volumes, and rising interest rates are all contributing to a challenging 2022.

- But, if we consider 2021 the outlier and not the benchmark, the market in 2022 doesn’t look nearly as catastrophic as headlines suggest.

- In fact, from a business perspective, there is significantly more money flowing through the system (from commissions) than any year other than 2021.

Mike DelPrete is a real estate technology and market strategist.

This column does not necessarily reflect the opinion of RealTrends’ editorial department and its owners.

To contact the author of this story:

Mike DelPrete at mike@mikedp.com

To contact the editor responsible for this story:

Tracey Velt at tracey@hwmedia.com